Post Study Work Options: How to Get a Work Visa for Malta After Your Studies

[su_spoiler title=”Contents in this Article” style=”fancy” icon=”plus-circle” anchor=”#Contents”]

[su_spoiler title=”Contents in this Article” style=”fancy” icon=”plus-circle” anchor=”#Contents”]

- Work Permit

- Documentation required to register as a jobseeker

- Special Residence Programme

- Naturalised Citizenship

- Citizenship by Investment

Malta is a southern European country in the Mediterranean Sea. It gained its independence from the United Kingdom in 1964 and became a republic in 1974. Malta is a tourist destination with numerous recreational areas and historical monuments, including nine UNESCO World Heritage Sites. The country is one of the smallest and densely populated countries in the world.

Malta has a rich tourism industry, film production and electronics manufacturing. They are progressive in nature and have taken steps to increase their level of technology use in several industries. The health care system in Malta is widely considered to be the 5th best in the world and one of the major factors international students stay after completing their studies.

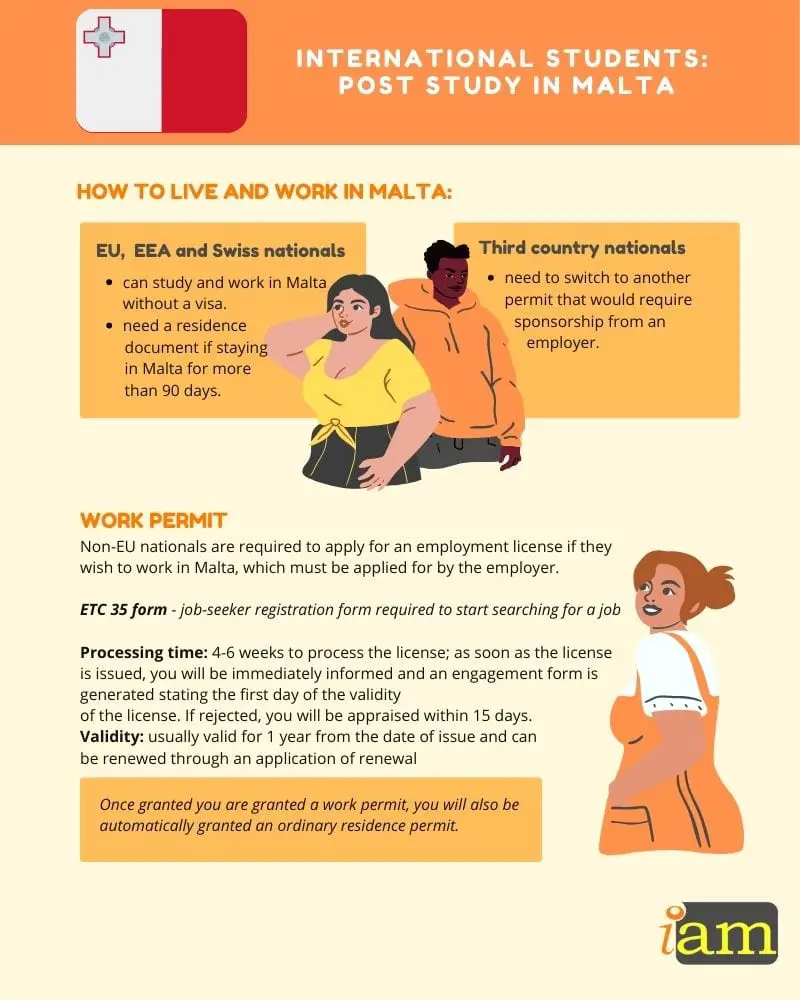

Malta is part of the European Union that supports borderless travel across member states thus EU international students can study and work in Malta without a visa. However, they need to acquire a residence document if they want to stay in Malta for more than 90 days.

Non-EU international students who would like to stay in the country after completing their studies need to switch to another permit that would require sponsorship from an employer.

While studying, you are permitted to work with your student permit so you should use this time to get work experience and widen your social network. Although it is hard to maintain your studies and part-time job, however it pays to know the right people and get their recommendation to assist you with your job search.

Work Permit

Non-EU nationals are required to apply for an employment license if they wish to work in Malta. The license must be applied for by the employer. To start searching for a job, you must fill out a registration form (ETC 35) as a job-seeker. This does not guarantee that you will be hired nor that you will be issued with an employment license, as only the employer can issue these. The employer must be able to prove that a candidate from the EU, EEA, Switzerland nor a Maltese national is capable of fulfilling the vacancy. You can also personally submit your application but it won’t hurt if you broaden your chances.

Documentation required to register as a jobseeker

Once you have filled out the ETC 35 form you must take it to the Job Center where you will be required to provide the following documents:

- ID Card

- NI number

- The registration form (ETC 35)

- Your curriculum vitae or resume if available

- Any certificates you may have

If you successfully found a job, your employer will need to apply for the license so you can start working legally. The following documents are required to get the license.

- Application form

- Curriculum vitae

- Position description

- References / testimonials

- One passport photo

- Copy of travel document

- Copy of valid visa

- Copy of qualification certificates and accreditation / recognition

- Cover letter by employer indicating the site of work

- Paid fee

- Evidence through a detailed vacancy report that shows that EEA / Swiss / Maltese nationals were initially sought to fill the position

It will take approximately four to six weeks to process the license. As soon as the license is issued, you will be immediately informed and an engagement form is generated stating the first day of the validity of the license. If rejected, you will be appraised within 15 days.

Employment licenses are usually valid for one year from the date of issue and can be renewed through an application of renewal. The application must be sent in 8 weeks prior to the expiry of the current employment license. Should the application be sent in later than those 8 weeks, once the prevailing license expires, the employee is no longer allowed to work until the renewal is resolved.

Once granted you are granted a work permit, you will also be automatically granted an ordinary residence permit.

Related posts:

- How to Get a Slovenia Work Permit After Studies: Post Study Work Visa Slovenia

- Post Study Options: How to Get a Post Study Work Visa in Norway

- How to Get a Post Study Work Visa Sweden: Post Study Work Options

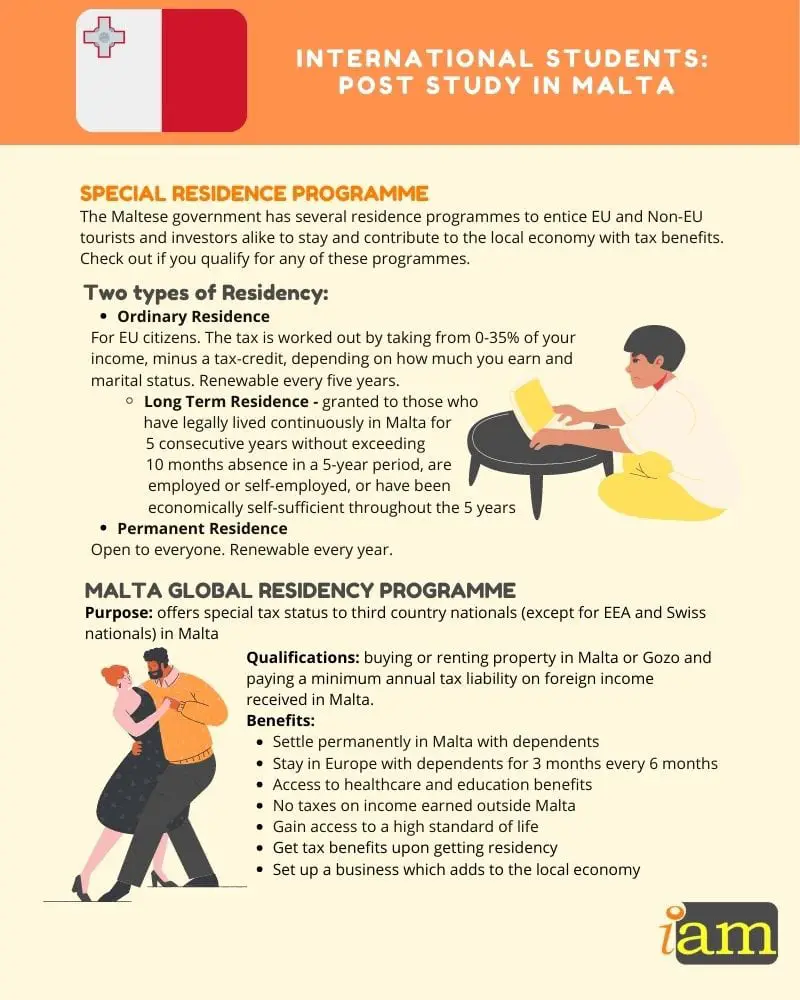

Two Types of Residency

Depending on where you are emigrating from you can apply for one of two types of residency: the Ordinary Residence or the Permanent Residence. The difference between the two ultimately boils down to how much you are taxed.

Ordinary Residence

Ordinary Residence applies to people coming to Malta from the EU. The tax you pay is worked out by taking from 0-35% percent of your income, minus a tax-credit, depending on how much you earn and marital status.

Long Term Residence

Long-term resident status is granted once you have legally lived continuously in Malta for five consecutive years. The total absence from Malta may not exceed a period of ten months within the five-year period. You should be able to prove that you are employed/self-employed, or economically self-sufficient throughout the five years.

Permanent Residence

Permanent Residence is open to everyone, no matter what your country of origin is. You will need to renew your ordinary residence permit every five years, while permanent residence permits are renewable every year.

Special Residence Programme

The Maltese government has several residence programmes to entice EU and Non-EU tourists and investors alike to stay and contribute to the local economy with tax benefits. Check out if you qualify for any of these programmes.

The Malta Global Residency Programme

In July 2013, the Maltese Government introduced a new residency programme. This offers special tax status to third country nationals (except for EEA and Swiss nationals) in Malta. To apply for this programme you need to satisfy certain criteria such as buying or renting property in Malta or Gozo and paying a minimum annual tax liability on foreign income received in Malta. Under this program, investors gain permanent residency for themselves and their families to Malta and access to various resident benefits.

Benefits under this program:

- Settle permanently in Malta with your dependents

- Stay in Europe with your dependents for 3 months every six months

- Get access to healthcare & education benefits

- No taxes on income earned outside Malta

- Gain access to a high standard of life

- Get tax benefits upon getting residency

- Set up a business which adds to the local economy

To qualify, you need to prepare the following documents:

- Passport & travel history

- Adequate health insurance

- Educational and business credentials

- Not be a Maltese, Swiss or EEA national

- Hold a qualifying property (rental of 10, 000 EUR per annum or purchased for a minimum price of 270, 000 EUR)

- Hold Malta Government stocks (minimum value of 250, 000 EUR*) for a minimum period of 5 years

- Have an annual income of not less than €100,000 from outside of Malta OR have net assets (ex: property, share, bonds, insurance policy and other fixed assets) of not less than €500,000.

Malta Residence Programme

The Malta Residence Programme Rules (the “Rules”) provides for a Malta Special Tax Status which can be availed of by all EU/EEA/Swiss nationals. The Rules entitles you to a Special Tax Status provided you comply with a number of criteria. All foreign sourced income received shall be taxable at 15%, with the possibility of claiming double tax relief on such income subject to a minimum tax of €15,000 annually. Any other chargeable income received by the beneficiary will be charged to tax at the rate of 35%.

In order to qualify for the benefits provided for in the Rules the you must:

- hold a qualifying property* which must be occupied only by the applicant and dependents.

- be in receipt of stable and regular resources which are sufficient to maintain himself and dependants

- not be a Maltese or a third country national

- not benefit under any other Malta Special Tax Status

- be in possession of sickness insurance in respect of all risks across the whole of the European Union normally covered for Maltese Nationals for himself and his dependents

- be in possession of a valid travel document

- be able to adequately communicate in either one of Malta’s official languages

- be a fit and proper person

In order to maintain one's special tax status, a beneficiary is required to:

- retain qualifying property holding

- not become a Maltese or third country national;

- not become a permanent resident of Malta;

- retain the necessary insurance;

- not stay in any other jurisdiction for more than 183 days; and

- adhere to all special reporting obligations and notifications.

*A qualifying property means:

- A property situated either in Malta for a value of €275,000 or situated in Gozo or the South of Malta for a value of €220,000

- A rented qualifying property of at least €9,600 per annum for a property situated in Malta or €8,750 per annum for a property situated in Gozo or the South of Malta

Qualifying Employment in Innovation and Creativity

The Qualifying Employment in Innovation and Creativity are available to nationals of the European Economic Area, Switzerland and third countries.

These Rules allow persons employed in a role directly engaged in carrying out, or management of research, development, design, analytical or innovation activities, to enjoy a 15% flat personal tax rate on income generated from their direct employment in Malta.

For a candidate to qualify, their annual income must exceed €52,000. This does not include the value of fringe benefits and applies to the derived income received from an eligible office. IIndividuals must be in possession of a relevant qualification or adequate professional experience for a minimum of three (3) years in a role comparable to that of the Eligible Office.

In addition to the minimum annual income requirement, a beneficiary must satisfy the following criteria which requires that they:

- are not domiciled in Malta

- do not derive employment income subject to tax and received in respect of work carried out in Malta or any period spent outside Malta in connection with such work or duties

- are protected as an employee under Maltese law

- prove to the satisfaction of the competent authority that they are in possession of professional qualifications

- are in receipt of stable and regular resources which are sufficient to maintain them and the members of their family (without recourse to the social assistance system in Malta)

- reside in accommodation regarded as normal for a comparable family in Malta and which meets the general health and safety standards in force in Malta

- with a valid travel document

- has health insurance

Naturalised Citizenship

You are eligible for citizenship if you have resided in Malta for five of the last seven years and for all of the last twelve months. To apply you need to have two sponsors to support your application. The sponsors must not be related to you. Any citizen of Malta may act as sponsor provided that he/she did not acquire Maltese citizenship by naturalisation.

First sponsor should be any of the following:

- A member of Parliament

- A judge

- A magistrate

- An advocate

- A notary public

- A legal procurator

- A medical practitioner

- A public officer not below the rank of principal

- A police officer not below the rank of inspector

- An officer of the Armed Forces of Malta not below the rank of captain

- A parish priest

The second sponsor may be any citizen of Malta who does not belong to any of the above-mentioned professions.

One of the benefits of being a citizen of Malta is the visa-free travel in any of the Schengen member states and Maltese passport is ranked 9th strongest passport.

Citizenship by Investment

Malta is one of the countries offering citizenship by Investment. As a growing number of wealthy private individuals are looking at investment migration as a way of giving themselves, and their immediate family members, the opportunity to live a better life in a more stable environment. This created an economic niche for citizenship by investment programmes. You and your dependant must have a global health insurance coverage of at least €50,000 and must provide evidence that they can maintain it for an indefinite period.

To be eligible, you must meet the following conditions,

- make a contribution of €650,000 to the Maltese Government, which is deposited in the National Development and Social Fund (NDSF);

- lease a property for a minimum value of €16,000 per annum, or purchase a property for a minimum value of €350,000, both in Malta and cannot be let or sublet; and

- acquire €150,000 worth of stocks, bonds, debentures, special purpose vehicles or other investment vehicles as may be identified from time to time by Malta Individual Investor Programme (MIIPA).

Malta citizenship through investment is granted by a Certificate of Naturalisation, and once you obtain EU citizenship via the Malta Individual Investor Program you will have it forever and can even pass it on to future generations.

Want to live and work in Malta after your studies? Comment below.

IaM can help with your visa application to the United States, the UK & other countries

If you need help with a US visa, a UK Visa, or visa to Europe, including help with appointment booking obligations, IaM can help.For more information and advice on US immigration, UK immigration law and US visa applications Or If you need any help or assistance please, reach out to your Visa Coordinator at IaM.

- Portugal Plans For Longer Residency and Stricter Visa Rules Ahead - 9 July 2025

- EES Gets Green Light For Phased Border Control Rollout - 8 July 2025

- ESTA Fee for US Travel Set To Increase - 7 July 2025